The DropertyTax Process

1. Notifications: First, you will receive your property value assessment from the municipality. This is the proposed value on which the local government will levy a property tax lien on your home. In order to generate enough local revenue the municipality will add up all of the property values and divide by the proposed budget, giving them a rate that they as a government need to charge each individual in order to support local activities. Expenses such as roads, schools, sanitation, and salaries.

2. Appeal: You now have a very short period of time to file a property tax appeal, usually a 15-45 day window. You must also fill out the appropriate forms and include any supporting evidence for your argument. A failure to meet the minimum standard will get your case thrown out even before someone looks at the front page of your appeal. We handle this entire process as the Authorized Representative.

3. Deadline: You must file the tax appeal before the deadline. If you miss the deadline, you miss your chance for that entire calendar year.

4. Results: The results of your appeal will be sent out 1-10 months later, depending on the area. If your assessed value is not lowered, then you can appeal to the state level, a service that we also handle.

5. Payment: Once you receive notification that your property assessment value has been lowered, we ask for 1/2 of your first year savings. You keep 1/2 of your first year savings and 100% every year after that.

Please contact us if you have any questions about the DropertyTax.com appeal process.

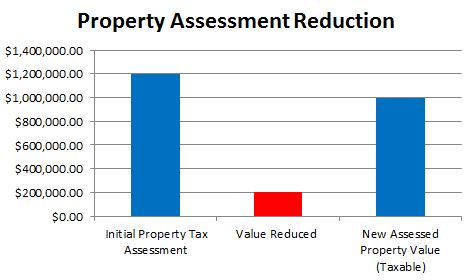

Example Case:

Initial Property Tax Assessment Value - $1.2 Million

After DropertyTax Process

New Assessed Value - $1 Million

Reduced Value - $200,000

Tax Rate (Mill Rate/Levy) - 2%

Total Yearly Savings - $200,000 x 2% = $4,000

First Year Savings - $4,000 x 50% = $2,000

DropertyTax Success Fee - $4,000-$2,000 = $2,000